China Paradigm interviewed Johnny Chang, the founder of Spa Solutions Training and Management Consultancy Ltd., Shanghai. With more than 20 years of experience in the Chinese Spa industry, Johnny is a true expert and strategist of the Chinese spa market and he gave a thorough introduction of the sector from market segmentation, revenue streams, to new trends.

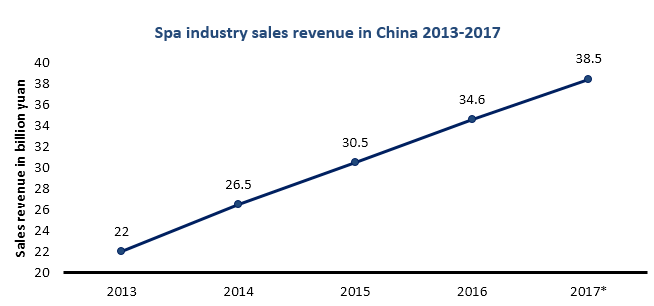

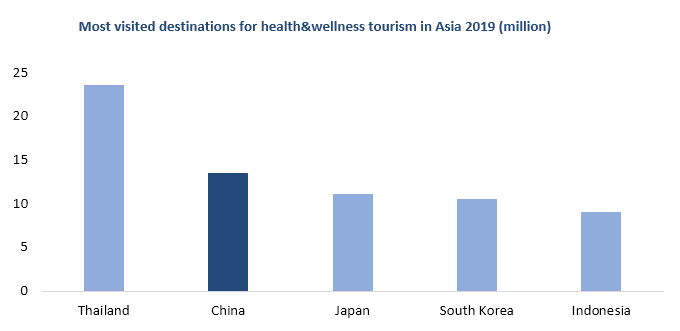

According to Statista, the Chinese spa industry was growing steadily from 2013 to 2017 and the market is expected to continue in this manner. Also, the health and wellness industry has been booming because travelers to and from the country are increasingly more aware of their social well-being and willing to travel further to treat themselves to the best spa and wellness products and services. For instance, APAC is the fastest-growing wellness tourism market where health and wellness trips increased by 33% between 2017 and 2019 to reach 109.4 million. China is the second popular destinations in APAC.

As for market segmentation in the Chinese spa industry, it can be segmented into four main types: Hotel spas, day spas, medical spas, beauty salons, and nail shops. Services are increasingly similar between hotel spas and day spas, but hotel spas generally have better equipment and higher price positioning. He also stated that medical spas have been growing in popularity in China. This type of spa has different services and different licensing requirements. Because treatments in this category are invasive, that is, under the skin, such spas need to get a license from medical administration.

Similar to other industries in China, the Chinese spa industry is also facing challenges because of COVID-19. As spas are mainly offline business, the pandemic dealt a sever blow to the whole industry and many companies were forced to close down. However, as China is recovering from the Pandemic, the negative influence of COVID could be seen as new opportunities for the Chinese spa industry as revenue management becomes even more crucial for them to focus on.

Key suggestions and interesting numbers for spa management in China

There are two important factors required to succeed in the Chinese spa industry. The first is revenue management and the second is personalization. Spa companies have two sources of revenue: treatment sales and retail sales which refer to skincare products and accessories such as bathing suits. Based on their calculation and experience, Johnny Chang suggested a safe number to quickly assess whether they have a healthy and profitable spa business: the retail sales should at least account for 19% of revenue. Also, membership cards are a complex topic for spa management in China as regulations differ among spa types. For example, the Chinese government has less strict regulations towards hotel spas. Provided there is a gym at the hotel, hotel spas are allowed to sell gym membership cards which can include a certain amount of spa treatment services. On the contrary, day spas can no longer use a membership system as part of their business model. The adoption of this model in the past ended badly as there was no limitation on duration, implying that day spas can only count a membership card as revenue when the card is used up. Therefore, it is dangerous for spa management in China if managers are not aware of this issue. Treatments generally become more expensive over time and the managers are likely to spend this money early on leading to customers returning possibly years later and being unable to use their membership cards.

“They are confused. Most of them are entrepreneurs. They thought they collect the money and it’s their money already. Actually, no it is still their customers’ money. Never touch it. So, the more you take in, the more you are in danger.”

Personalization is another keyword that has been emphasized by Johnny Chang continuously. He mentioned that what Chinese customers need from the spa industry is wellness which comes from physical, mental, and emotional satisfaction. It requires personalization for both treatment and retail products. In the Chinese spa industry, this requirement means companies should understand Chinese culture and it can help them to understand customers better. Identifying customer needs is the key for personalization, all employees need to observe and listen to customers, enabling them to offer the right services or develop personalized services in the future, which is the key for spa management in China to generate sales and keep their clients returning.

“The revenue consistency is from repeat clients and it is difficult to find the repeating clients. You need to spend 6 more times to find a new client instead of keeping an old client.”

Forecast and strengths of premium hotel spa business in China

The number of tourists venturing to hotel/resort spas within China is forecast to double from 7.5 million in 2018 to 14.8 million by 2022 and hotel/resort spas have the most substantial growth. As previously mentioned, the premium hotel spa business in China is different from other segments in terms of pricing, regulation, and strategies (Learn more about China’s hotel industry trend). The prices for treatments from premium hotels range from 1000 to 2000 RMB. Premium stores can afford expensive equipment which reduces the labor cost and provide more effective treatment.

Premium hotel spas have a higher potential to get stable and healthy revenue structure because the proportion of total revenue that comes from retail sales revenue is higher, in some cases even reaching up to 65% of total revenue according to Johnny Chang. The fluid cash flow gives them the flexibility to invest and improve their services. To explain it in detail, the premium hotels usually operate at a 50% margin and they don’t have to pay inventory fees because of their well-known brand image, allowing them to gain a considerable revenue stream. As for typical clients of premium hotel spa business in China, the customers are not segmented by age or culture but a lifestyle. Target customers for premium hotel spas will be people who spend money and they love the new concept and lifestyle.

Explore the trend in China’s spa market

Because the Chinese spa industry is influenced by COVID-19, as an example of a trend in China’s spa market, Johnny Chang listed one in particular: immune-boosting treatments are becoming popular in China. Customers are more aware of their health and are willing to return and pay for packages related to immune-boosting.

Based on his experience in bridging western and eastern culture, Johnny Chang also believes it’s important to realize the maturity of the e-commerce ecosystem in China which could have a potentially enormous impact on the trend in China’s spa market. Furthermore, by observing the successful application of pairing the different workout programs with different types of music in order to stimulate the interests of the consumers in the fitness industry, Johnny Chang sees a potential crossover for this technique to be applied in the Chinese spa industry.

Another trend in China’s spa market is the requirement for certification. However, Johnny Chang emphasized alignment between the acquirement of certification and practical practices.

“It is really important and so with a certificate, there is not much use to help generate your revenue without knowing or understanding how important the guest experience is. This is something missing, but it is changing.”