China Paradigm interviewed Geoffrey Handley, a serial entrepreneur to grasp his investing acumen and learn as much as possible about business investment in China.

Geoffrey Handley, an experienced entrepreneur and knowledgeable investor in China

Geoffrey is a global entrepreneur who has founded companies five times; Geoffrey is also a qualified investor at the same time. Geoffrey Handley and his partners used to invest in promising companies in China.

Geoffrey’s acumen of business investment in China is sometimes contentious. Their competitors and other giant investment banks may not be ever interested in the startups that Geoffrey invested in. He has sets of principles in what type of business is most worth investing in. He prefers to invest in the industries he is familiar with, as he said,

“We don’t have billions of dollars in multiple funds – we’re founders, not finance.”

Geoffrey has built a strong relationship with the companies he invested in. He helped the founders with strategy planning and business modeling, and his motto is not to treat the founders as business partners but as humans. Business investment in China is not only to invest in the business but also in human relationships. As both the business founder and investor, Geoffrey has a deeper understanding of the relationship between investors and investees.

Haitao Capital, the first macro-driven fund devoted to investing in encouraging start-ups in China

Haitao Capital is the first macro-driven Chinese fund, ‘macro-driven’ here refers to the unfair advantage in specific Chinese business sectors that are driven by the Chinese macro environment. They have their focus on four business sectors: care, creation, culture, and consumption. For example, the Chinese insurance industry in ‘care’ sector is a booming business worth investment:

“Care for us is anything from health care to insurance to elder care – to childcare & everything in between. It can be hardware, it can be software, it can be serviced as a priority.”

Investing in promising companies in China is to some extent investing in China’s promising future. Haitao has invested in some technology start-ups in China which may at first not be well recognized by the technological industry, however, with the help of and cooperation with Haitao, they are able to achieve their full potentials.

China’s foreign investment policy, no special benefit, and no discrimination

To develop a business in China, especially for foreign entrepreneurs, it is important to understand China’s foreign investment policy. For example, the “One Belt One Road” policy has brought a connection between China and other foreign countries, therefore, it has absolutely provided massive opportunities for foreign investment.

“One Belt one Road, 77 countries. The largest infrastructure and capital expenditure are known to mankind. In that are 77 countries, you can build amazing fast-growing companies there that are dominating sectors that will never set foot in China.”

It is worth mentioning that such a government policy could benefit any investor in China, it wouldn’t give any special benefit or discrimination on foreign investment. As Geoffrey commented, the Chinese government is the most transparent government in the world, because every announcement from the government will be accessible online within a short while. The government itself is a great source of information, it has provided foreign investors in China with stability and unity. What’s more, when Geoffrey choosing promising companies to invest, he won’t give priority to Chinese founders because every company is under the gradual transformation of Chinese policy:

“China’s domestic policy is changing, which means that I don’t need to invest in a Chinese company with Chinese founders based in China.”

Invest in encouraging start-ups in China, grow side by side with them

We have already talked about Haitao’s interest in investing in encouraging start-ups in China, they are not only funding them but also help start-ups develop in the initial stage. Geoffrey has offered an example about 247, an online ticket selling website in China. Geoffrey has spent several whole days with 247’s CEO to discuss the company’s future and the next steps to take. Geoffrey claimed that instead of doing the funding, investing in encouraging start-ups in China is actually very ‘hands-on’, very involved:

“It is not just from the financial return of investment, it’s almost a personal undertaking as well, as founders we all had mentors.”

The most distinctive characteristic of Haitao Capital compared with other investment companies is that Haitao is composed of previous founders. Being investors now, they are backing other founders, so they know so well what founders will need in their strategic planning:

“We need to stick to what you’re good at and what your strength is, then that’s our space, and that’s naturally where the value that we add, to these companies, be it way beyond the capital.”

In this sense, Haitao is not just capital for investing in encouraging start-ups in China. Through their unique understanding of running a business and data-driven strategies, there is no doubt that Haitao is a trusted partner and reliable business mentor for founders of start-ups. They could make a contrarian decision sometimes at all costs, as long as it is a worthwhile investment in their perspective.

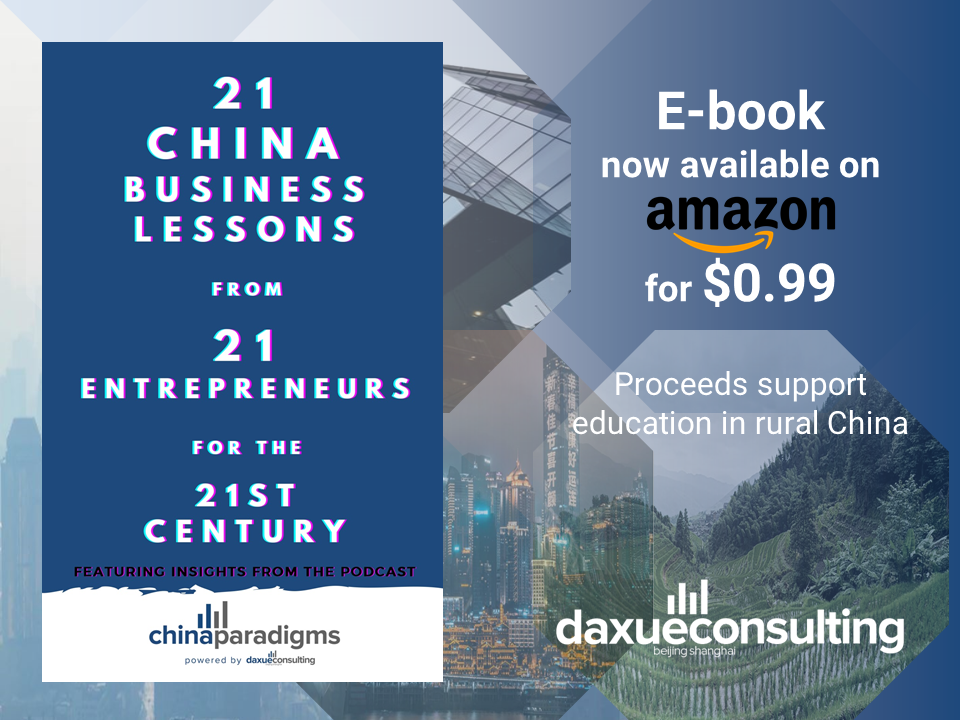

Listen to China Paradigm in iTunes